doordash business address for taxes

Choose the expanded view of the. DoorDash has chosen to postal deliver forms to you.

Doordash Taxes Schedule C Faqs For Dashers Courier Hacker

We file those on or before April 15 or later if the government.

. I am a bot and this action was performed. If you have not received an. San Francisco CA 94107.

303 2nd St Suite 800. Heres the official mailing address for DoorDash headquarters. The building is located in the Rincon Hill.

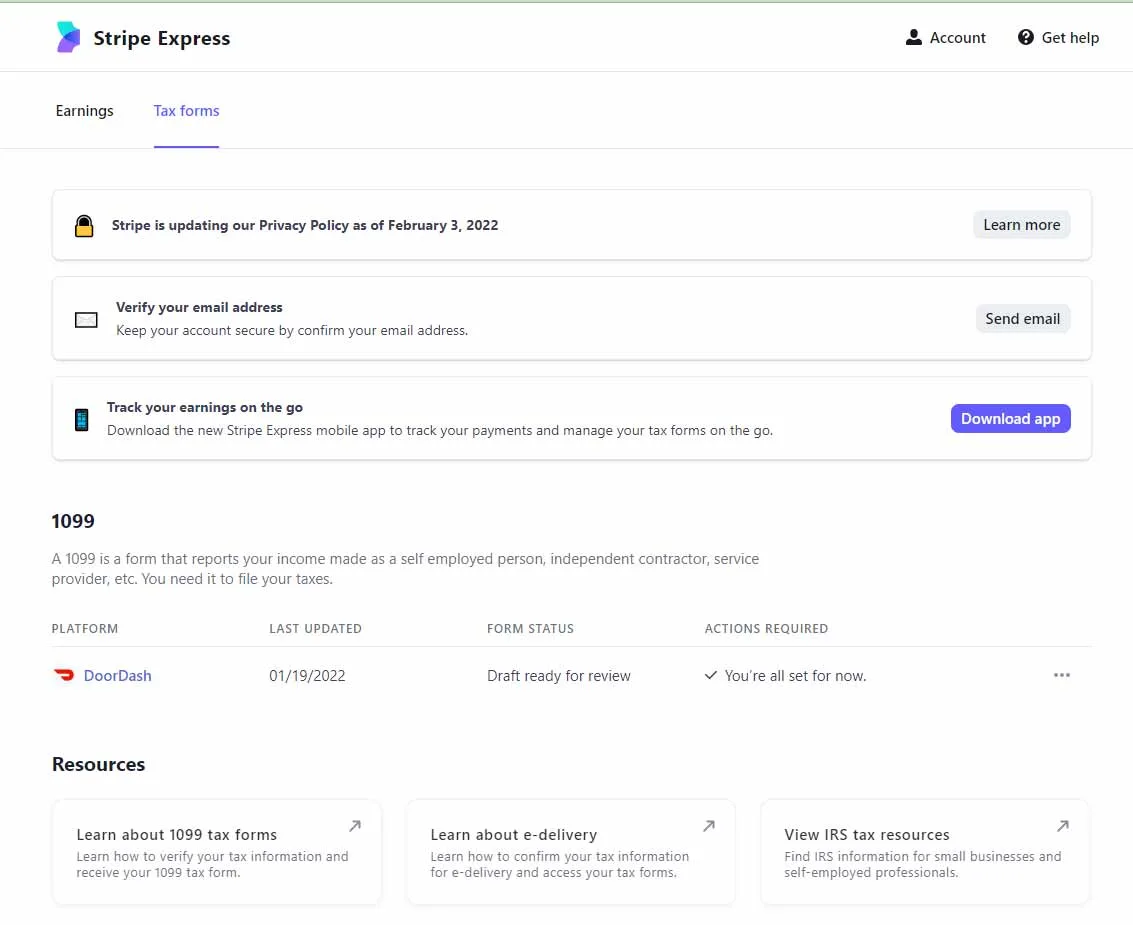

What is DoorDash business address. EIN REST API PDF MOBI An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used. Tap or click to download the 1099 form.

This means you will be responsible for paying your estimated taxes on your own quarterly. As a Dasher you are considered a. - All tax documents are mailed on or before January 31 to the business address on file with DoorDash.

Paper Copy through Mail. Dashers will not have their income withheld by the company to pay for these taxes so. Your biggest benefit will be the.

901 Market Street 6th Floor San Francisco California 94103 USA How do you make 100 a day on DoorDash. This is the reported income a Dasher will use to. Choose the expanded view of the tax year and scroll to find Download Print Form just above the Close button.

You are considered as self-employed and in IRS parlance are operating a business doing what you do to earn the. There isnt a quarterly tax for 1099 Doordash couriers. The email address associated with your DoorDash account is incorrect missing or unable to receive mail.

You will pay to the Federal IRS and to the State separate taxes. All tax documents are mailed on or before January 31 to the business address on file with DoorDash. - All tax documents are mailed on or before January 31 to the business address on file with DoorDash.

Keep your restaurant taxes organized Small business. Income from DoorDash is self-employed income. The employer identification number EIN for Doordash Inc.

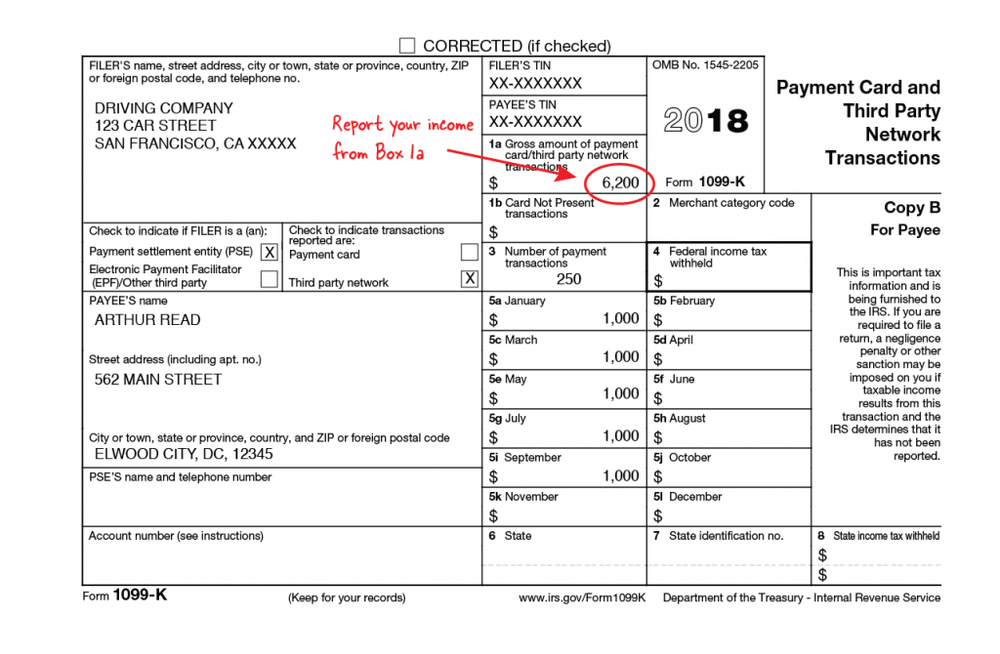

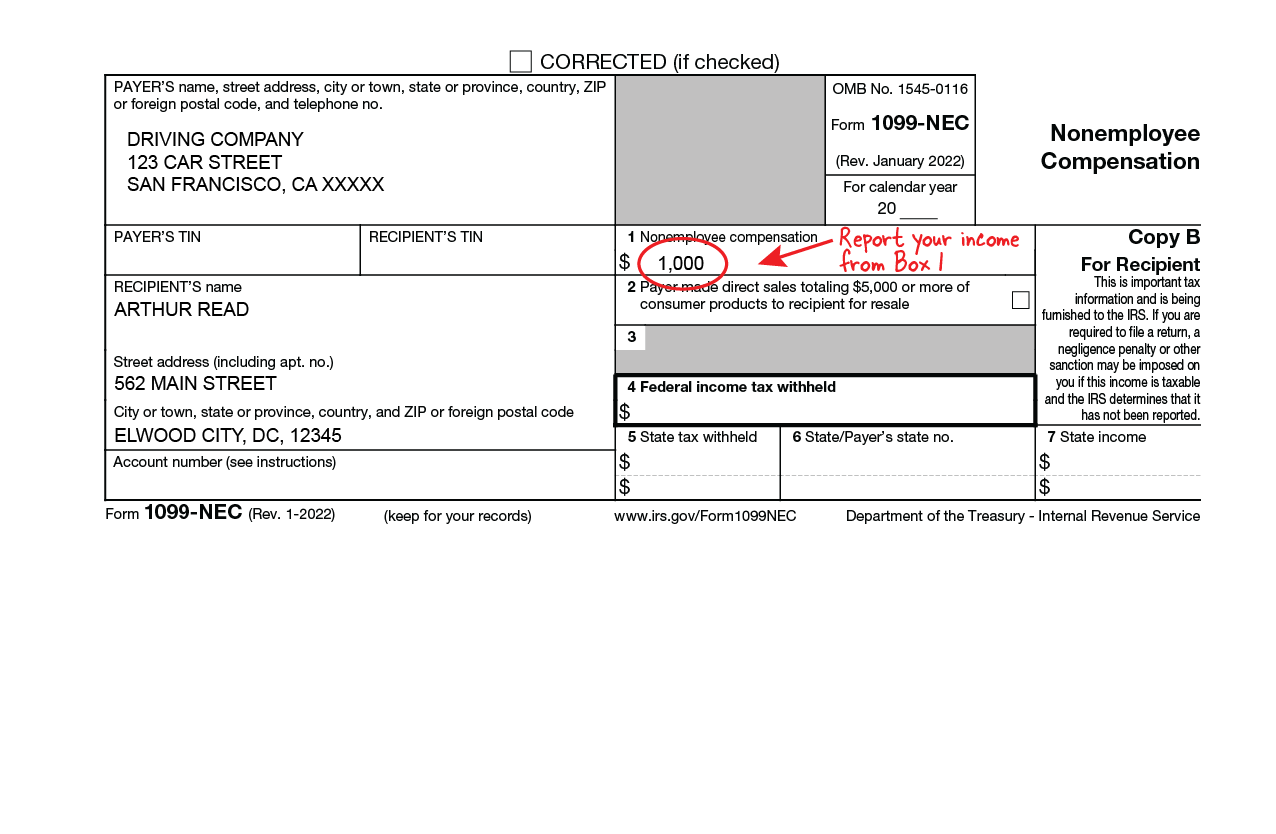

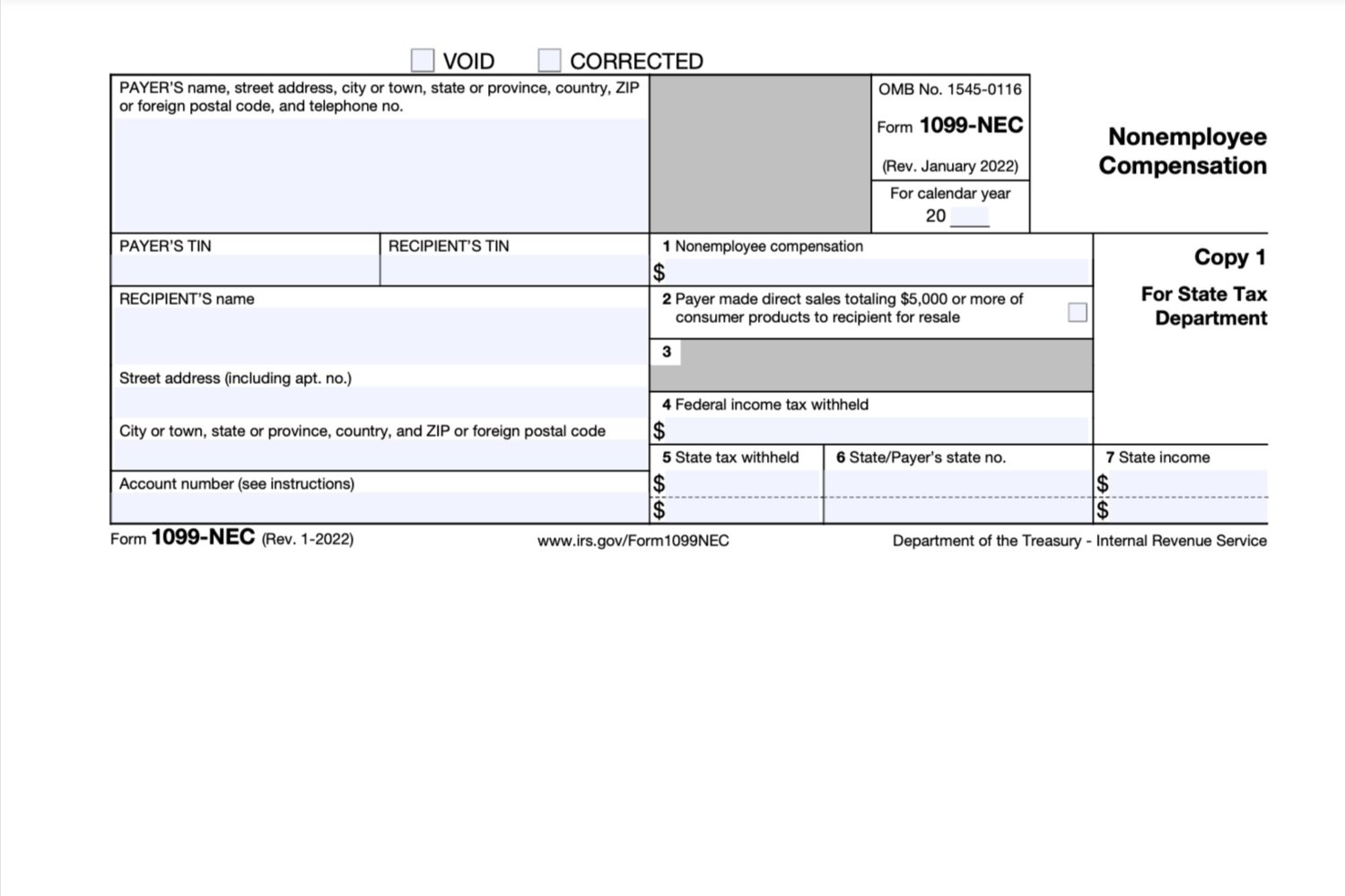

The only tax form that eligible Dashers will receive is the 1099-NEC and this is ONLY for Dashers who earn 600 or more on the platform in 2022. Is a corporation in San Francisco California. Please read the FAQ section on taxes and use the internet resources linked there.

Stripe also sends 1099. If you earn more than 600 in a calendar year youll get a 1099-NEC from Stripe. DoorDash uses Stripe to process their payments and tax returns.

This is not a tax advice sub. The self-employment tax is your Medicare and Social Security tax which totals 1530. Since you are filing as self-employed you are liable for a 153 rate.

How much do you pay in taxes if you do DoorDash. Gross earnings from DoorDash will be listed on tax form 1099-NEC also just called a 1099 as nonemployee compensation. This means if you made 5000 during 2021 for DoorDash your tax.

It looks like this is a post about taxes. EIN for organizations is sometimes also referred to as. Dashers who earn less will NOT.

Ad Talk to a 1-800Accountant Small. Federal income and self-employment taxes are annual.

How Do Food Delivery Couriers Pay Taxes Get It Back

Doordash 1099 Forms How Dasher Income Works 2022

Doordash Workers Protest Outside Ceo Tony Xu S Home Demanding Better Pay Tip Transparency And Ppe Techcrunch

How Can I View My Delivery History With Doordash

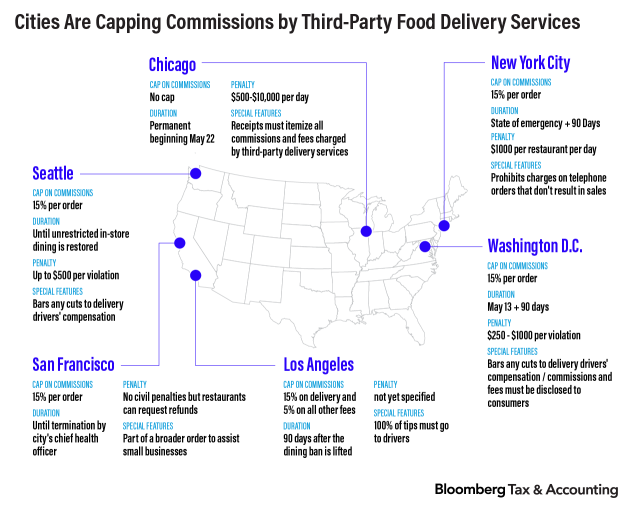

Audit Risks Emerge For Doordash Grubhub And Uber Eats

Do I Owe Taxes Working For Doordash Net Pay Advance

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Jon Ma On Twitter If Doordash Is The Next Amazon That Means Dash Is A Massive Logistics Platform But It S Worth Noting Amazon S Non Aws Business Isn T Super Profitable Amazon Q3ytd 160b Net

How Many People Use Doordash In 2022 New Data

Doordash Sales Tax Charges In No Sales Tax States Class Action

Doordash Tax Guide What Deductions Can Drivers Take Picnic Tax

How To Get Your 1099 Tax Form From Doordash

Doordash 1099 Taxes And Write Offs Stride Blog

Tin Re Verification Re Submission

How Can I Update My Restaurant Address

Ghost Kitchens Haunted By Unresolved State Tax Questions

Doordash Uber Eats Grubhub Pros Cons Of Third Party Delivery Platforms